*Disclaimer; Crypto trading is extremely risky, and even experienced traders can face liquidation. This article is for informational purposes only and is not financial advice.

It’s about that time in the financial season when we’re starting to hear low-volume claims that a new crypto ‘’bull-run’’ is soon to be upon us.

And you don’t want to miss your chance to get rich quick by smartly circumventing the traditional routes to achieving financial freedom - otherwise you're an idiot…you’ll typically be told by the online gurus.

And you’ll forever remain a slave to the system whilst all those clever crypto traders are happily retired, sipping mojitos in some exotic tax-heaven.

So it’s no surprise that literally millions of people are now either already seriously considering, or are at least highly intrigued by, the prospect of investing in crypto currencies.

This includes many small-business owners and self-employed individuals that are part of the Crunch audience and client-base.

So we wanted to shed some light on the reality of investing in crypto to help demystify this seemingly, and supposedly, novel and exciting financial opportunity. So you can at least be armed with a basic understanding of what it is and the risks/challenges involved.

In this article we’ll look at some simple case studies that demonstrate the potential and limitations of investing in crypto. As well as some of the giant hazards presented in the industry, along with some pointers for finding and making quality investments.

First let’s briefly establish a few key points about crypto so you can better understand the information about investing in it.

What exactly is a crypto currency?

We won't go into a lengthy explanation here as there are countless videos and articles that explain this in depth widely available online, and this article focuses on whether or not investing is a sound idea, but FYI here’s a basic overview.

A crypto currency, in its first, original form (i.e. Bitcoin), was an alternative, decentralised form of digital money that you could use to pay for goods and services like a fiat currency.

The main differences being that it is:

- Used, and payments are sent, via an encrypted ‘’blockchain’’ network between decentralised, anonymous, personal digital wallets.

- Exclusively a digital, paperless currency.

- Totally decentralised, meaning that you have complete ownership and control over your funds outside the centralised banking system.

It’s main advantages are said to be that it is:

- Much more secure than centralised payment systems, as Bitcoin’s ‘Lighting’ blockchain network can’t be hacked thanks to all transactions between wallet addresses on the chain being fully visible to all users, yet also anonymous and encrypted.

- Incredibly faster than traditional, fiat payment systems. Facilitating almost instant transactions anywhere in the world.

- Fully decentralised, so government authorities can never seize your assets (provided you keep them in a cold-storage wallet).

Hence Bitcoin is often described as ‘’perfect money’’.

Nowadays of course there are over ten thousand crypto currencies in addition to Bitcoin. Some of their main other functions, aside from a few also being a somewhat usable currency, include:

- Providing/supporting blockchain-based smart technologies like smart-contracts and Trusted Execution Environments, for Web 3. applications.

- Providing crypto trading and investment products like staking platforms

- Tokenised gaming apps and services

- Memes - not a function, but fun?

Moreover, these are the real-life ‘’functions’’ of the projects that the coins fund. So the basic premise is that when you buy a certain amount of a crypto currency, or an alt-coin (any crypto currency other than Bitcoin), you are essentially investing in, or crowd-funding, the block-chain based tech project it represents. The development company that owns the project lists its coins on a crypto exchange so people can buy them.

Obviously in the hope that the coin/currency will go up in value, which is greatly dependent on the success of the project.

For a more detailed description of the different types of crypto currencies and what they are check out this article.

Should you invest…?

So, now we need to address the core question of the article - is investing in crypto a good idea?

Clearly it’s not going to be a binary answer, as there are many factors to consider depending on your individual circumstances, etc. But let’s keep it simple and look at a quick list of the pros and cons to gain some rapid context.

Pros of crypto investing:

It’s the quickest way to grow your wealth, by far. As the potential gains are astronomical and the entry level is exponentially low. It is possible to turn £1000 into £100,000 in a couple of years.

Highly accessible, as there’s no minimum investment amount. You just need to sign up with your passport and bank account to a crypto exchange

24-hour market. Unlike the stock market you can trade around the clock, 365 days per year.

Generous tax-breaks in some countries. For example in Portugal crypto is completely tax-free for individual investors.

Vast number of assets. As there’s over 10,000 crypto currencies you’ll never be short of opportunities.

Cons of crypto investing:

Volatile market. Its biggest strength is also its biggest danger. Prices can move very quickly in both directions…

A lot of scams. Crypto is full of scammers trying to steal your coins, or persuade you to invest in their dodgy projects

Questionable longevity. Most financial experts think that crypto is just a bubble, to put it politely. (Although this is strongly contested by others, to be fair.)

Lack of security and protection. Cold-storage wallets might offer the ultimate level of safety from thieves however, if YOU make a mistake with crypto a transaction, then it’s very difficult to get your funds back.

These are all points you’ll have to consider and research further yourself, but they should give you a break-down on the key concerns for those new to crypto investing.

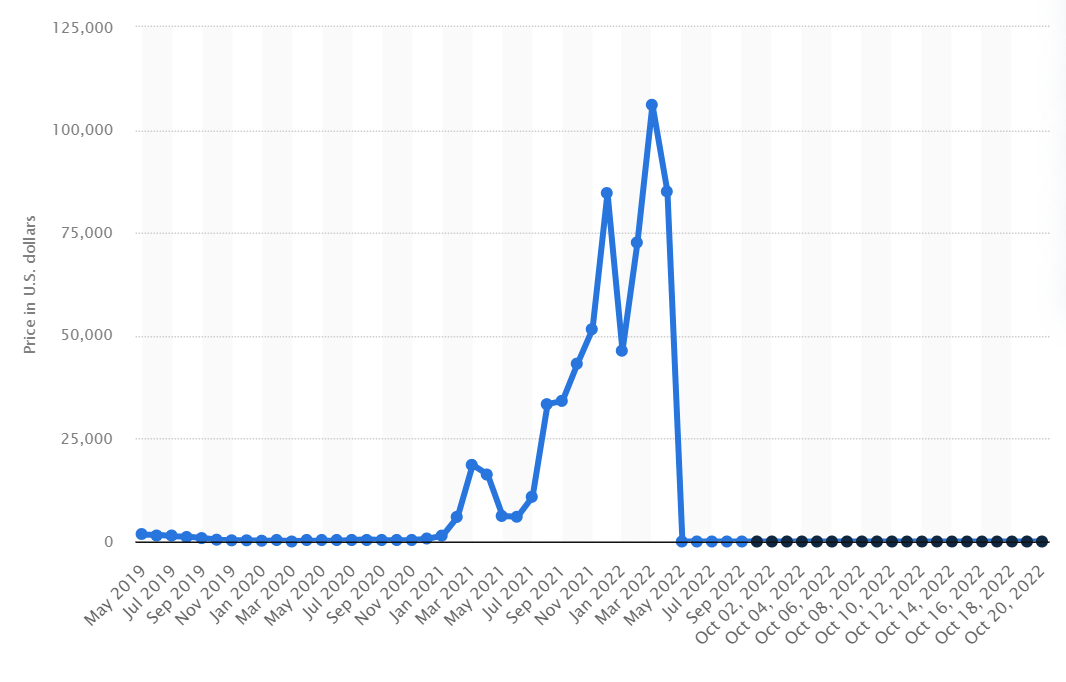

Luna - the rise and fall

To show you tangible evidence of the incredible gains that can be made, and lost, in the crypto market, we can look at the history of Luna. A wildly successful project that eventually crashed big-time. Leaving a lot of people questioning why they got involved in crypto currency, and some lucky/wise investors with life-changing wealth.

Luna was a coin built on the Terra network, a blockchain network like Bitcoin or Etherum, that also produced a stable-coin (a crypto currency that is always the same value as the dollar) called UST.

UST, being a stable-coin (ironic, yes), was ‘’pegged’’ to the US dollar. Meaning 1 UST was worth $1. But instead of being backed by actual cash dollars, it was backed by algorithms connected to the price of Luna.

And Luna essentially derived its value from the use of UST. So in 2022 when $2 billion dollars of staked UST was taken off the staking platform Anchor, UST came crashing down bringing Luna with it. From a height of $116 to a low of under 10 cents.

You don't need to understand the terminology here, but you should be able to see how lucrative, yet precarious, crypto assets can be.

The lesson here is don’t be greedy, get out when you have a decent return on your investment. Many skilled and knowledgeable investors got ‘’wrecked’’ by Luna.

Here are a couple more price charts that show the volatility of crypto assets:

Floki:

BNB:

As you can see, there is clearly serious money to be made, with small market-cap projects exploding into valuable assets in a matter of weeks sometimes. But you need to know with some precision, when to exit the market to avoid losing your gains.

The crypto market is also highly sensitive to industry events and subsequent media coverage. So you'll need to monitor this regularly to stay ahead of the game.

Most of the projects that the coins fund are experimental, and the developers often just pack-up leaving everything to collapse. So if you do choose to try your hand at crypto, follow the golden-rule of investing and ensure you never invest money you can’t afford to lose.

Scams

Unfortunately the crypto industry is littered with scammers and fake gurus. Many of the old-fashioned, self-help marketing scammers have recently morphed into crypto ‘’experts’’ trying to flog you their bogus and useless training courses.

We won’t name any names but we recommend checking out Coffeezilla’s youtube channel to educate yourself. Also across social media sites you’ll find countless scammers trying to steal your crypto by impersonating legitimate industry experts. So watch out for this.

You should also familiarise yourself with the case of Celsius. A crypto staking platform that went bust after financial mismanagement and fraud. Sadly, an all too common occurrence in the industry, which unsurprisingly contributes to the imperfect reputation of crypto.

Although the centralised finance industry isn’t exactly squeaky-clean…

The CEO, Alex Mashinsky, deceived customers by promising insane 20% staking rewards on USDT (another USD stable-coin), whilst trying to push up the price of their own Clesius coin which he hoped to sell himself for a massive profit.

Long story short, a large number of people will likely collectively lose billions of dollars. And Alex Mashinsky could well be facing life in prison.

It’s all too easy to be seduced by the promises of professional fraudsters, and the crypto space is fertile ground for them with its lack of regulation and government oversight.

Key investment principles

We don’t want to start issuing financial advice on specific investment strategies or what assets to invest in. But we’ll leave you with a few general and broadly accepted key principles to adhere to:

- Research the coins/projects you invest in. Learn about the developers, the funding, the KPIs/growth targets, the use cases of the technology, the marketing and the community.

- Have a strategy. It’s best to pick low-risk long-term investments, ideally with a small market-cap if you can find them.

- Follow the signs. When well-known traders start posting pictures of their cars and watches this is a sign that the market is overheated and it’s time to sell.

- Avoid leverage trading! We didn’t go into this as it’s a whole other subject but this is a super risky type of trading/investing that can easily end up with you needing to sell your house…

Overall the majority of crypto assets are most likely part of a bubble that will burst at some point. However, if you have a spare £1000 or two that you don’t mind gambling with then it’s probably one of the best opportunities to turn that into £20,000 or £30,000+ that you’ll find.

But certainly don’t start thinking about using your kids' inheritance to become a millionaire overnight. That won’t end well for anyone whatever the outcome.

It’s best to have price targets that you think are realistic and stick to them. And don’t punish yourself if you miss out bigger gains - no one gets poor by taking profits.

If crypto sounds like a complete mug’s game or a ponzi scheme for the twenty-first century to you, then there's absolutely no shame in continuing to do what you do best and enjoy most. By continuing to run your business and help your clients whilst getting rich slowly. Getting better at that is probably one of the wisest investments you can make.

The information provided in this article is for general informational purposes only and should not be construed as financial or tax advice. We recommend consulting with a qualified tax advisor or financial professional who can provide personalised advice tailored to your specific circumstances.

.svg)

.webp)