Bank reconciliation made simple

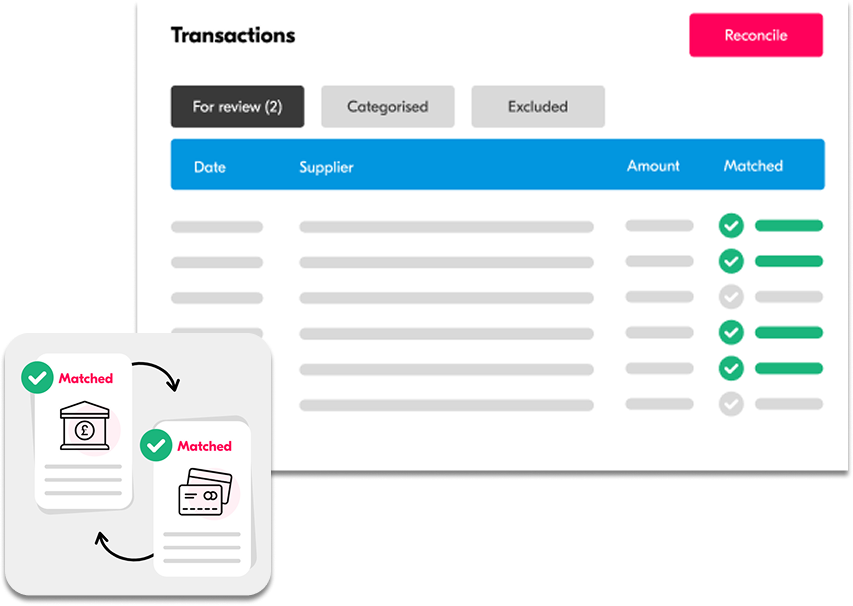

How our bank reconciliation software works

Automated where it helps. Human where it matters.

Our bank reconciliation software takes care of the routine tasks so your accounts stay accurate and up to date. And when you want more than just smart software, our expert accountants are here.

From proactive tax-saving advice to those tricky questions that send you down a Google rabbit hole, we’re here to make accounting the easiest part of running your business.

Why Crunch stands out

Crunch offers everything you need to make bank reconciliation and accounting easy, with features that set us apart from the competition. Here’s how we compare:

**Compared to other accounting software providers

Frequently asked questions

Explore our FAQs for quick answers to your questions

Keeping your records accurate is essential for smooth tax filing and financial management. If you need support, our accounting packages are the perfect companion to your software. Each one includes unlimited access to our team of Chartered Accountants and your own dedicated Client Success Manager.

Our qualified accountants are here for all the tricky tax stuff. And for everything else, your client success manager is ready to help, from quick questions to making sure you get the most out of your account. That is the kind of support you will not find with most accounting providers.

Bank reconciliation is the process of comparing your bank statement with your accounting records. This is often made easier by using bank reconciliation software, like Crunch. For example, Crunch automates bank reconciliation by securely importing transactions daily* via Open Banking and AI to suggest the right category. If you’re new to bank reconciliation (or not) we’d recommend checking out our Knowledge section as it’s packed full of expert tips to make bookkeeping a breeze. Including bookkeeping basics for ecommerce sellers to an ultimate guide to self-employed bookkeeping. We’ve got you covered!

Bank reconciliation software is a tool designed to help businesses match their accounting records with their bank statements. Good bank reconciliation software simplifies the process of tracking income and expenses, and ensures all transactions are accounted for correctly.

There are a few different bank reconciliation tools available, including Crunch. But we’d like to think that ours is the best for the job, and here’s why: Crunch offers an easy-to-use platform that automates most of the reconciliation process, saving you time and stress. With our Open Banking integration, you can ensure your transactions are matched accurately and quickly, all with minimal effort on your part. Plus, you get the added bonus of support from real human experts when you need it—something you won’t find in competitors. So, why settle for anything less?

Yes! Crunch’s bank reconciliation software automates the majority of the process. With automatic transaction imports thanks to Open Banking and one-click reconciliation, Crunch helps you save time and eliminate errors… all while keeping your books up-to-date effortlessly.

Bank reconciliation should be done regularly—at least once a month, but it’s better to do it more regularly—to ensure that your financial records are accurate. We’re proud to say that our bank reconciliation software makes it possible to do this on a daily basis as transactions are imported automatically*, and you only need to reconcile them as they come in.

It’s crucial because it keeps your financial record accurate and up-to-date. Keeping records updated is crucial for tax filing, financial reporting, and managing your business effectively. It also helps you spot errors or fraudulent activities early, protecting your business from financial discrepancies.

Still have questions?

.svg)