The Statutory Residence Test was introduced by HMRC to determine the tax residence status of individuals with connections to the UK.

The Statutory Residence Test, while complex, is vital when it comes to understanding your UK tax status and could mean that your worldwide income is subject to UK tax. Failure to correctly declare and pay tax on any income could lead to penalties and fines.

If you’re classed as a UK tax resident, you’ll be taxed on your worldwide income, unless your permanent home (‘domicile’) is abroad. This includes:

- Wages, if you work abroad

- Foreign investments and savings interest

- Rental income from an overseas property

- Income from pensions held overseas.

{{tax-guide}}

But what if I’ve paid tax on my foreign income already?

You can claim Foreign Tax Credit relief when you report your overseas income on your Self Assessment tax return.

The tax relief you’ll get depends on the UK’s double-taxation agreement with the country your income comes from. You can usually get relief even if there isn’t an agreement. This is called Unilateral relief; Foreign Tax Credit relief is generally given at the lower of the actual tax suffered and the equivalent UK tax on the same income.

How do I know my tax status?

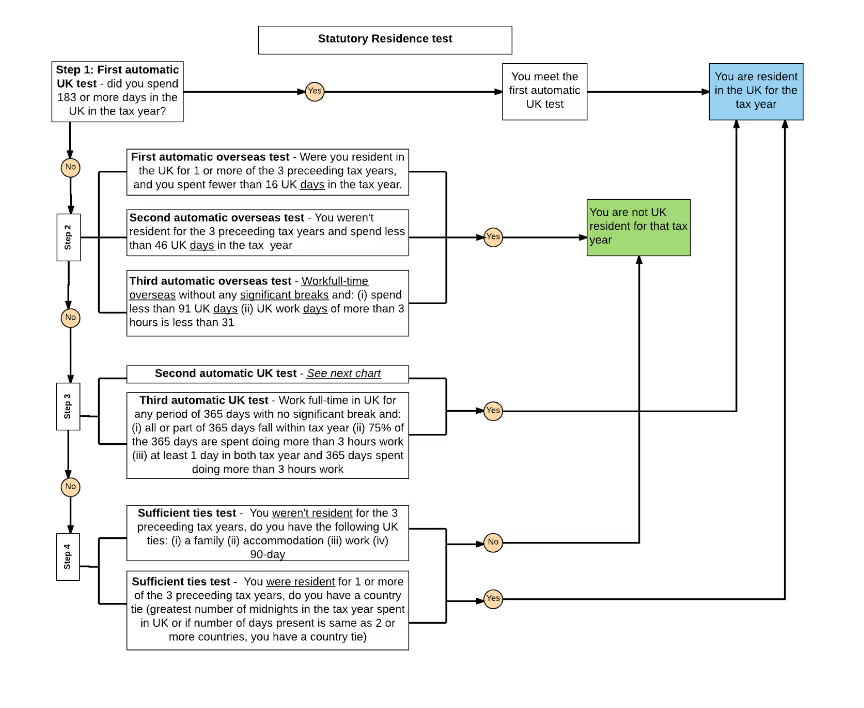

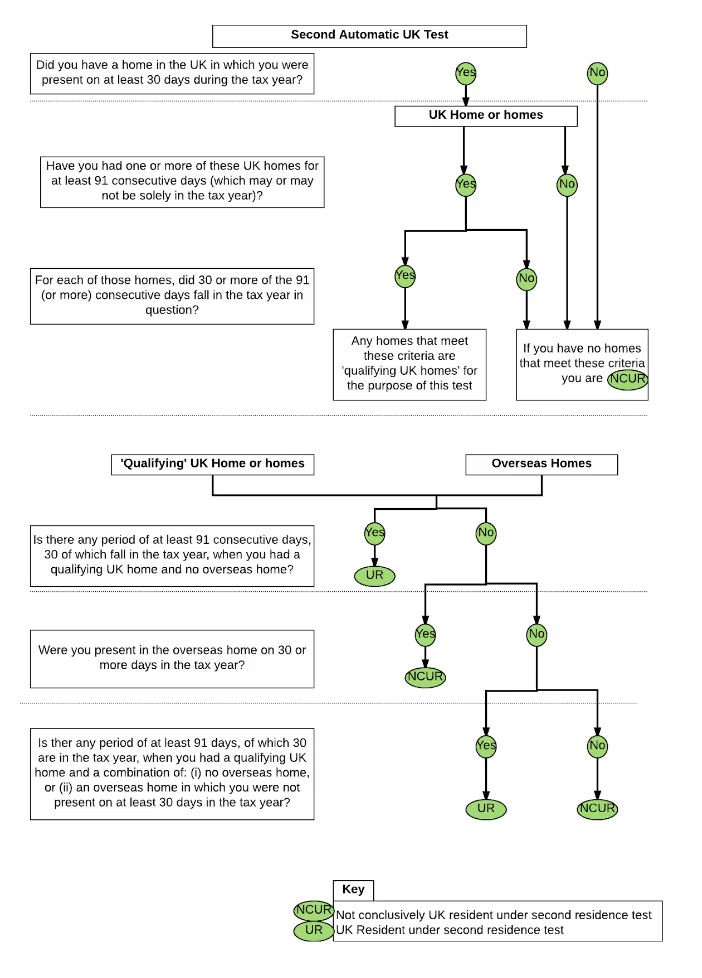

HMRC have produced guidance on their website to help you understand your tax residence status. The charts below walk you through a simplified tax residency process.

Due to the complexity of the Statutory Residence Test, it is always advisable to seek professional advice from a tax expert to determine your residence status.

HMRC's tool

HMRC have simplified a previously complicated process by releasing an interactive tool that should make the process easier for all.

Still confused?

Don’t worry if you’re finding HMRC’s language or questions difficult – you’re not the only one!

If you’re a Crunch client we can help you work out your UK Tax Residence position, please get in touch with your client managers and we’ll arrange a discussion with one of our expert accountants. However, as highlighted above, Crunch does not provide advice in this area and we recommend you speak to an expert in tax residency matters after our initial discussion.

In order to help you, we’ll need you to provide answers to the following questions. We are assuming the latest tax year ended on 5th April 2025.

- How many days were you resident in the UK in the last full tax year between 6th April 2024 and 5th April 2025?

- How many days were you in the UK in the previous tax year between 6th April 2023 and 5th April 2024?

- How many days did you work in the UK (a working day means more than three hours per day) in each of the above tax years?

- How many days did you work overseas (a working day means more than three hours per day) in each of the above tax years?

- Did you have a UK home in the tax year between 6th April 2024 and 5th April 2025? If yes, for how many days?

- Did you have an overseas home in the tax year between 6th April 2024 and 5th April 2025? If yes, for how many days?

- What date did you arrive in the UK?

- What date did you leave the UK?

- Where were you born?

- Where were your parents born?

- When are you likely to return to the UK?

- Where do you consider to be your current permanent home?

- Do you have any family or work ties in the UK?

At Crunch, we only take on clients who are UK tax residents with a residential address in the UK. If this applies to you, check out our What We Do page to find out how we can help you and your business with our online accounting software, complete accountancy packages, self-employed mortgages, Business Insurance and much, much more.

.svg)

.webp)

.avif)

.jpg)